Your Arsenal of Power

Every hero needs the right tools. These aren't just features - they're your weapons in the battle against emotional trading. Each one designed to give you the edge that separates winners from losers.

Core Features

Everything you need for disciplined, structured digital asset trading. Built for all traders, institutional-grade performance.

Feature Categories

Advanced ML Predictions

Advanced ML models trained on multiple timeframes with adaptive breakout analysis and confidence scoring. Result: Institutional-grade signal quality with advanced ML capabilities.

Real-time Trading Engine

Automated position management with DCA, scaling, and institutional-grade execution across 12+ exchanges. Result: Professional execution with transparent AI decisions.

Fund Protection

Your API keys, your funds. Trading permissions only, no withdrawals. Clear audit trails and full visibility. Result: Zero custodial risk with complete control.

Multi-Exchange Scanner

Monitors 12+ exchanges for momentum opportunities with breakout detection and volume analysis across all USD trading pairs. Result: Never miss opportunities with 24/7 market scanning.

Intelligent Alerts

Real-time notifications for entries, exits, and risk events, so you can step away from charts with confidence. Result: Trade anywhere with instant mobile alerts.

Advanced Analytics

Real-time performance tracking, trade attribution, and ML model insights with comprehensive reporting. Result: Data-driven decisions with institutional-grade analytics.

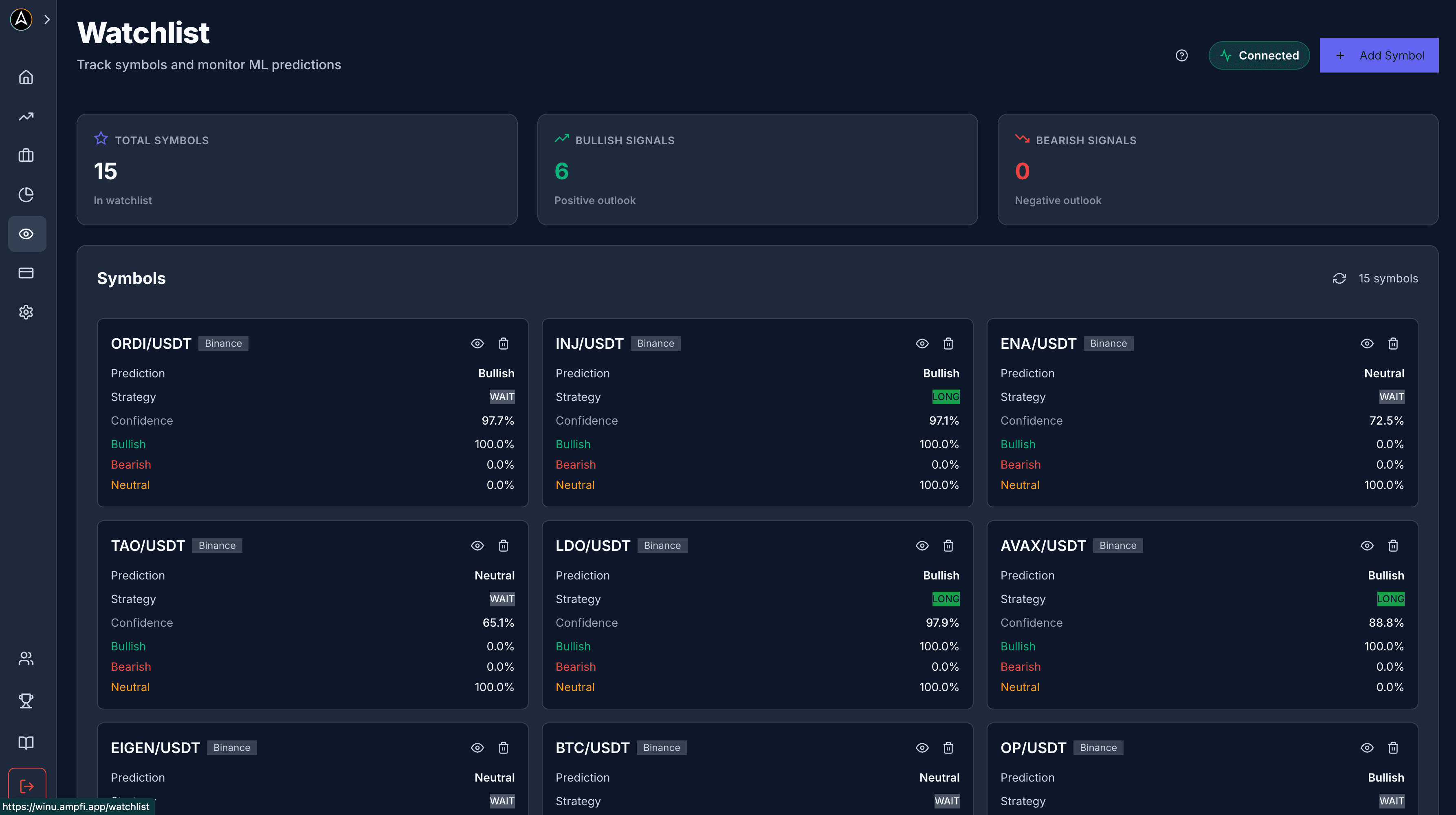

Advanced ML Predictions in Action

Experience the power of machine learning-driven trading predictions. Our ML-powered watchlist provides real-time cryptocurrency predictions with confidence scores and automated trading signals for multiple trading pairs.

Each prediction is backed by transparent AI analysis, showing you exactly why the system recommends specific entry points, target prices, and stop-loss levels. The watchlist dashboard displays bullish and bearish signals with confidence scores, helping you make informed trading decisions based on data-driven insights.

How Non-Custodial Trading Works

Complete transparency and control at every step

You Create API Keys

Generate trading-only API keys from your exchange. No withdrawal permissions, your funds never leave your control.

Winu Analyzes Markets

The system scans market data, identifies momentum opportunities, and produces clear, rule-based signals.

You Authorize Trades

Review each signal before execution. Enable automation for hands-off trading or manually approve each trade.

Orders Execute on Your Exchange

Trades execute directly on your connected exchange. Every order, fill, and result is visible in real time.

Security & Control

Your security is foundational

API Key Protection

• Encrypted in transit and at rest

• Least-privilege access model

• No withdrawal permissions requested

• Revocable by you at any time

Operational Practices

• Built on AWS infrastructure

• Network and access controls with least privilege

• Periodic security reviews

• Operational monitoring and alerting

Institutional-Grade Risk Management

Built-in safeguards to protect your capital

Position Sizing

Use rules that adapt sizing to your balance and preferences. Configure limits so you never risk more than intended.

Stop-Loss Discipline

Stops and trails can adapt to volatility, aiming to limit downside while allowing normal market movement.

Daily Guardrails

Define maximum daily drawdown thresholds and optional cool-off timers to reduce emotional decisions after losses.

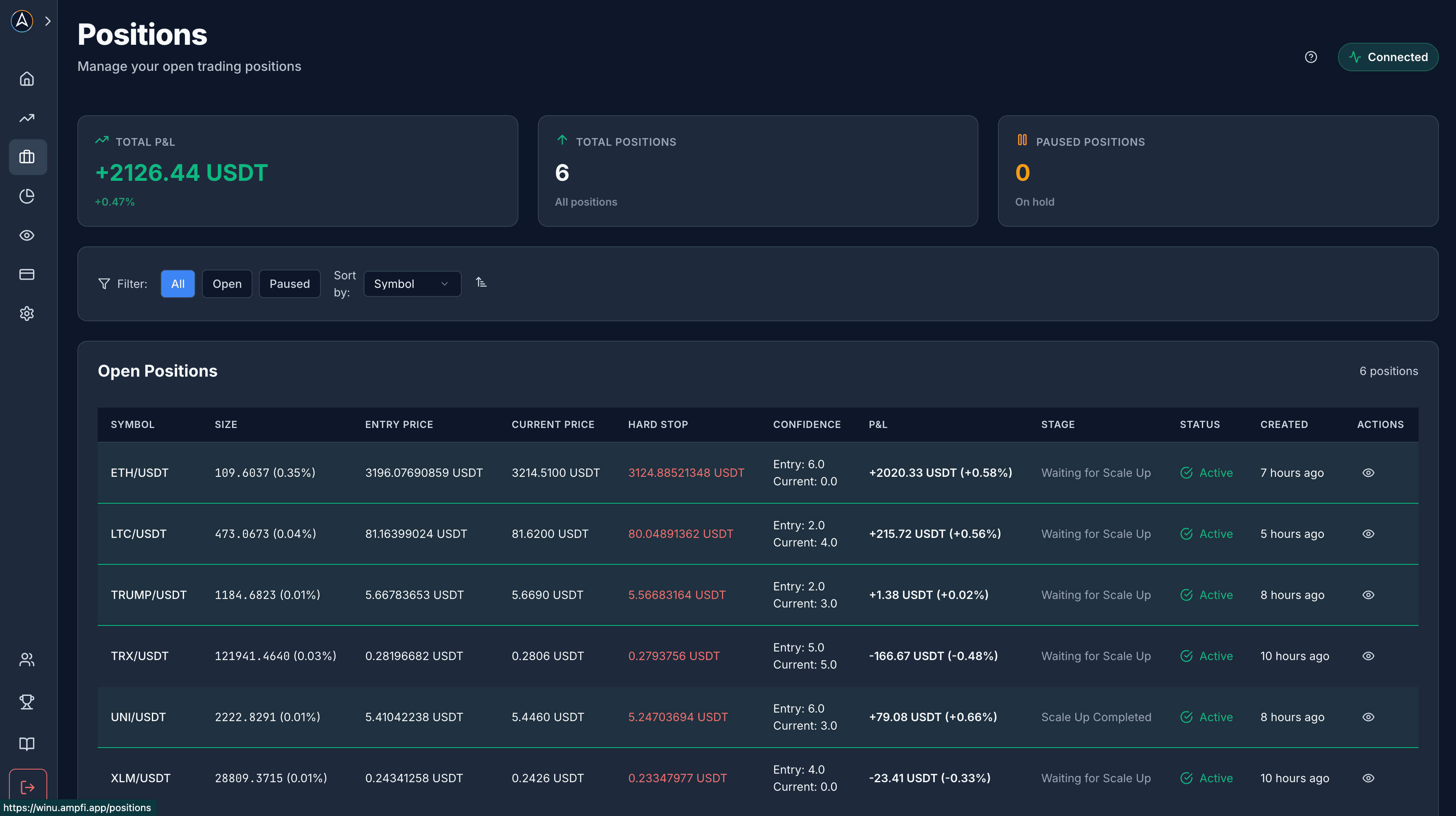

Real-Time Position Management

Monitor and manage your active trading positions with comprehensive real-time analytics. Track P&L, entry prices, hard stops, and confidence levels for each position.

Our position management dashboard connects directly to the institutional-grade risk management features, showing you exactly how your positions are protected by hard stops and risk controls. See active position status, real-time profit and loss, and confidence levels that help you understand the strength of each trade.

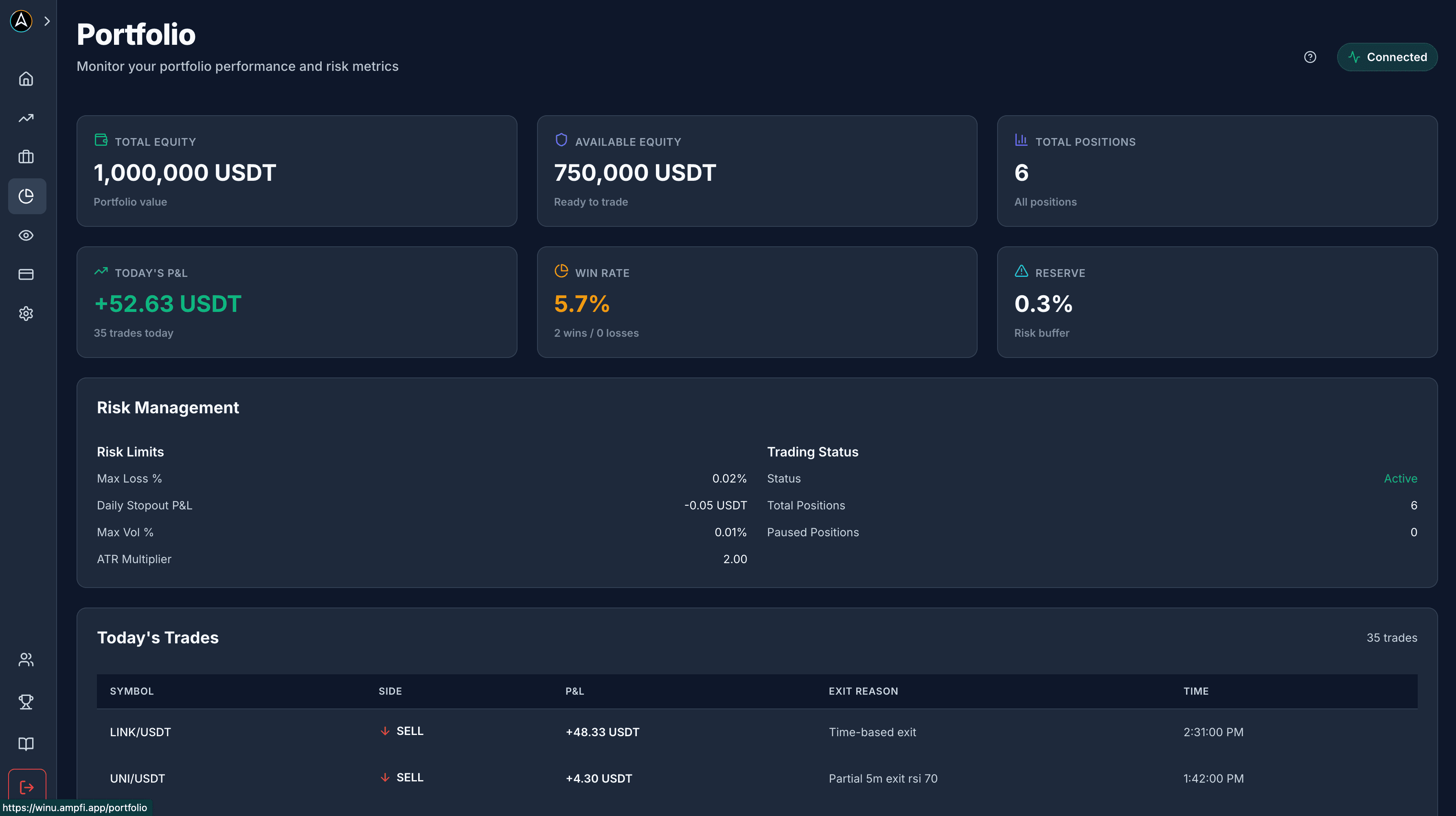

Portfolio Performance & Analytics

Get comprehensive insights into your trading performance with advanced analytics. Track real-time equity, P&L analysis, win rate metrics, and risk management settings all in one dashboard.

The portfolio dashboard provides a complete view of your account status, connecting to the Advanced Analytics feature from our Core Features. Monitor your total equity, available balance, trade history, and performance metrics to make data-driven decisions about your trading strategy.

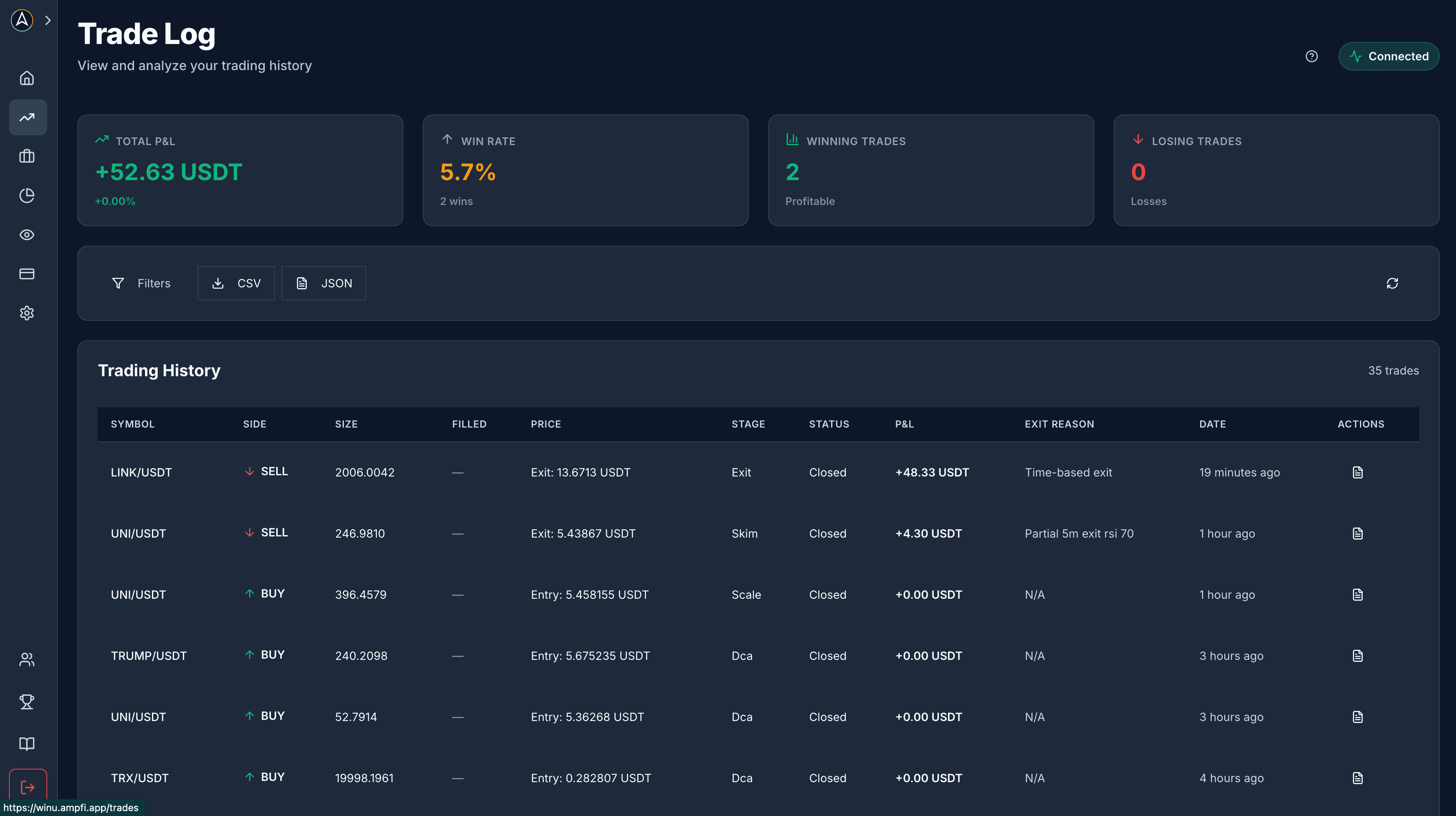

Trade History & Performance Analytics

Review your complete trading history with detailed analytics and performance metrics. Track every trade, analyze win rates, and understand exit reasons for comprehensive performance evaluation.

Our trade log dashboard connects to the Advanced Analytics feature and supports our transparency value proposition. Get comprehensive trade performance metrics, P&L tracking, and detailed exit reason analysis. This audit trail helps you understand what's working in your trading strategy and provides complete transparency into your automated trading system.

$50M Infrastructure Features

We've compressed advanced trading infrastructure into accessible software. What institutions spend millions on, you get starting at $400/month (Pro plan).

Institutional Infrastructure

The same $50M infrastructure that hedge funds use, compressed into accessible software.

Transparent AI

Every decision is explainable. See exactly why the AI made each trade decision.

Fund Security

Your funds stay on your exchange with trading-only API permissions. Complete control with institutional-grade security.

Ready to Access Features

Experience the full power of our feature set. Get access to specialized ML models, real-time trading engine, and advanced risk management starting at $400/month.